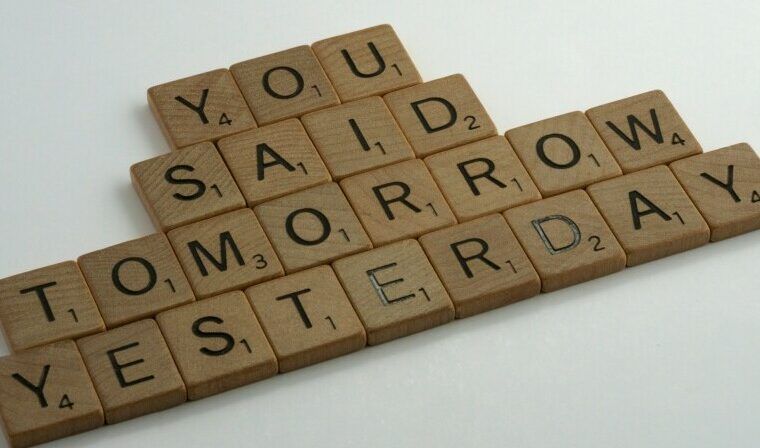

Procrastination is a common human behavior, often characterized by delaying tasks or decisions until later. While it might seem harmless at first glance, procrastination can have significant consequences, especially when it comes to finances. In this comprehensive guide, we’ll delve into the various pitfalls of procrastination in relation to financial matters. From managing debt to investing for the future, we’ll explore how putting off important financial decisions can impact your financial well-being in the long run.

Debt Accumulation

One of the most immediate consequences of procrastination in finance is the accumulation of debt. Whether it’s credit card debt, student loans, or overdue bills, delaying payments can lead to mounting interest charges and late fees. By procrastinating on addressing debt, individuals risk falling into a cycle of financial instability, making it harder to achieve their long-term financial goals. This can become very costly to you, as interest rates are at an all time high and the credit card agencies bank on you not paying your debt in full each month, so they can claim high interest on anything you owe. Plus, if you miss payments, they are likely to increase your interest rate even higher, and charge you additional fees. If you are having a hard time paying off your credit cards, consider applying for a new interest free card for 12 months, and transfer your balance. This way, you will have 12 months to pay off the balance without any interest, but DO NOT miss any payments, otherwise you will default to the high interest. We use Chase credit cards and we have been pleased with their service. You can even get a Chase Amazon Card that will earn you points with Amazon purchases.

Missed Investment Opportunities

Procrastination can also result in missed opportunities for investment growth. Delaying investment decisions, such as contributing to retirement accounts or purchasing stocks, can mean missing out on potential returns over time. The power of compounding interest means that the earlier you start investing, the more time your money has to grow. By procrastinating on investing, individuals may find themselves with less wealth accumulated for their future needs.

Emergency Preparedness

Another area where procrastination can have detrimental effects is in emergency preparedness. Failing to establish an emergency fund or purchase adequate insurance coverage can leave individuals vulnerable to financial crises, such as unexpected medical expenses or job loss. Procrastination in this area can lead to financial stress and desperation when emergencies inevitably arise. We never know when a disaster will strike, or un-employment or when a child will get sick and need medical attention. We must be prepared with at least 3 months of our families finances saved up in an account that we do not touch- except for emergencies.

Retirement Planning

Procrastination can significantly impact retirement planning efforts. Many individuals put off saving for retirement, believing they have plenty of time to catch up later. However, the reality is that the longer you delay saving for retirement, the harder it becomes to build a sufficient nest egg. By procrastinating on retirement planning, individuals may face the prospect of having to work longer than desired or having to rely on inadequate savings during retirement. If we procrastinate on this one, whew, that can be a really big deal. We use Fidelity.com for our investment needs, you can use this link to set up your own account.

Financial Decision-Making

Procrastination can also affect general financial decision-making. Whether it’s creating a budget, reviewing financial statements, or seeking professional advice, delaying these tasks can lead to missed opportunities for financial improvement. Procrastination can also result in impulsive decision-making when faced with financial challenges, leading to suboptimal outcomes. Making financial decisions is difficult, its understandable to discuss with your partner, or take some time to think about your decision, but just don’t wait too long, as making impulsive decisions is never a good thing.

Stress and Anxiety

Beyond the financial implications, procrastination can take a toll on mental health. Constantly worrying about overdue bills, mounting debt, or an uncertain financial future can lead to stress and anxiety. Procrastination perpetuates this cycle of stress by delaying action and prolonging financial uncertainty. Owing money can be very stressful. Of course there are ways we can reduce our stress relating to money, but the absolute best way is to be preventative and not to procrastinate in regards to our finances. Stress can cause some really serious medical conditions, then you will be spending even more money on medical bills- so again- let’s not procrastinate.

Lack of Financial Literacy

Procrastination can also stem from a lack of financial literacy. Many individuals put off financial tasks because they feel overwhelmed or unsure of where to start. However, by taking the time to educate themselves about personal finance principles and strategies, individuals can feel more confident and empowered to make informed financial decisions. I have a wealth of information on my website in regards to financial literacy and well being. For example this article here is great article on saving money during a recession.

Overcoming Procrastination

While procrastination can be challenging to overcome, it is possible with dedication and effort. Breaking tasks down into smaller, more manageable steps can make them feel less daunting. Setting specific goals and deadlines can also help hold individuals accountable and motivate them to take action. Seeking support from friends, family, or financial professionals can provide encouragement and guidance along the way.

Procrastination poses numerous risks to financial well-being, from debt accumulation to missed investment opportunities and inadequate emergency preparedness. By recognizing the pitfalls of procrastination and taking proactive steps to address them, individuals can better position themselves for financial success. Remember, the key to overcoming procrastination is taking small, consistent actions towards your financial goals. Start today and reap the rewards tomorrow.

Below you will find a list of 7 different specific ways that procrastination can be costly to you. Please pay attention to these and ensure that you are always paying attention to your finances in a timely manner.

Procrastination can cost you money in several ways:

- Late Fees and Penalties: Putting off paying bills, such as credit card bills, utility bills, or loan payments, can result in late fees and penalties. These fees can add up over time, increasing your overall expenses.

- Missed Investment Opportunities: Delaying investment decisions means missing out on potential returns. The longer you wait to invest, the less time your money has to grow through compounding interest, resulting in lost investment opportunities and potentially lower long-term wealth accumulation.

- Accumulation of Debt: Procrastinating on addressing debt, such as credit card debt or student loans, can lead to increased interest charges and a longer repayment period. This results in paying more money in interest over time and prolongs the cycle of debt.

- Higher Interest Rates: Procrastinating on improving your credit score or refinancing high-interest loans can result in higher interest rates. This means you’ll end up paying more in interest over the life of the loan, increasing the total cost of borrowing.

- Missed Savings Opportunities: Failing to take advantage of savings opportunities, such as employer-sponsored retirement plans or tax-advantaged accounts, can result in missed opportunities to save money on taxes and build a nest egg for the future.

- Increased Stress and Health Costs: Procrastination can lead to stress and anxiety, which can have physical and mental health consequences. Increased stress levels may result in higher healthcare costs due to medical treatment for stress-related illnesses.

- Loss of Financial Opportunities: Procrastination can lead to missed opportunities for financial growth and advancement, such as delaying career development efforts or failing to seize lucrative investment opportunities. This can result in lower income potential and decreased financial security in the long run.

Overall, procrastination can have significant financial consequences, leading to increased expenses, missed opportunities, and heightened stress levels. By addressing procrastination and taking proactive steps towards financial responsibility, you can avoid these costs and work towards achieving your financial goals more effectively.