Simplify & Save: A Practical Guide to Financial Freedom in the New Year

The start of a new year presents the perfect opportunity to reassess your financial habits and make meaningful changes that will benefit you throughout the year and beyond. By combining smart money-saving strategies with lifestyle simplification, you can create a sustainable path to financial wellness. Here’s your comprehensive guide to achieving both goals.

Start with a Financial Declutter

Just as you might declutter your home, begin by decluttering your financial life. Review all your recurring subscriptions and memberships. Many of us are paying for multiple streaming services, unused gym memberships, or forgotten app subscriptions. Create a spreadsheet listing every subscription, its monthly cost, and how frequently you use it. Be ruthless – if you haven’t used a service in the last three months, cancel it. This simple exercise can often save hundreds of dollars annually. Here is a great article that can help you identify the best tool to check for multiple subscription costs, some you may have forgotten about.

Embrace the Digital Financial Revolution (Wisely)

While technology can complicate our lives, it can also simplify our finances when used strategically. Set up automatic payments for regular bills to avoid late fees and stress. Use budgeting apps to track spending and identify areas for improvement. However, be selective – you don’t need five different financial apps. Choose one comprehensive platform that meets most of your needs and stick with it.

Implement the “One Account” Strategy

Maintaining multiple bank accounts and credit cards can lead to confusion and missed payments. Consider consolidating to one primary checking account, one savings account, and one or two credit cards. This simplification makes it easier to track your spending, reduces paperwork, and minimizes the risk of identity theft. Keep one backup credit card for emergencies, but resist the temptation to open new accounts for small signup bonuses.

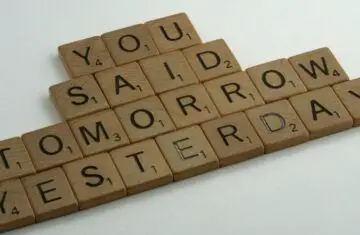

Adopt the 24-Hour Rule

To combat impulse spending, institute a personal 24-hour rule for any non-essential purchase over $50. Add items to your cart but wait a full day before buying. You’ll often find that the urge to purchase disappears, saving you from accumulating unnecessary items and expenses. This simple rule can dramatically reduce wasteful spending while simplifying your possession management. I have started this rule a few years back and it truly is life- changing. I often find that after 24 hours the want or need that I recently felt, just went away. This is a really helpful tool if you are an impulse or emotional spender.

Create Automated Savings Systems

Set up automatic transfers to your savings account the day after your paycheck arrives. This “pay yourself first” approach ensures saving becomes a priority rather than an afterthought. Start with 10% of your income if possible, but even 5% is better than nothing. As you adjust to living on less, gradually increase the percentage. We implemented this technique and it was super helpful to us, we were able to save money really quickly and we never even missed it, because it came out of our main bank account right after we got paid. We have really enjoyed using the online bank SOFI, so check that out, they have pretty good interest rates.

Embrace Minimalist Meal Planning

Food expenses often represent a significant portion of monthly spending. Implement a simple meal planning system: choose 10-12 core meals your household enjoys and rotate through them. Buy ingredients in bulk when possible, and prep meals in advance. This approach reduces food waste, simplifies grocery shopping, and prevents expensive last-minute takeout orders. I literally have fights in my mind about meal planning! It’s definitely a love/hate relationship for me. But I cannot deny how convenient and affordable it is, despite how annoying the process can be for me at times.

Rethink Transportation Costs

Transportation is typically the second-largest expense category for most households. Consider if you can reduce to one car or even go car-free depending on your location and circumstances. If eliminating a vehicle isn’t practical, explore carpooling, combining errands to reduce trips, or using public transportation when feasible. Each mile not driven represents savings in fuel, maintenance, and depreciation costs.

Create Clear Financial Boundaries

Learn to say no to financial obligations that don’t align with your goals. This might mean declining destination weddings, setting gift-giving limits with family, or being honest about your budget constraints with friends. While initially uncomfortable, setting clear boundaries simplifies decision-making and reduces financial stress.

Implement the “One In, One Out” Rule

For non-consumable items, adopt a one in, one out policy. Before buying something new, identify something you’ll remove from your home. This practice not only saves money but also prevents clutter accumulation and maintains simplicity in your living space. YES! set boundaries with yourself about big purchases especially, this rule is super helpful, in maintaining a de-cluttered household.

Focus on Experiences Over Things

Shift your spending toward experiences rather than material possessions. Experiences typically provide more lasting satisfaction and don’t require storage, maintenance, or eventual disposal. This might mean choosing a family camping trip over new electronics or taking a cooking class instead of buying more kitchen gadgets.

Build an Emergency Fund Systematically

Financial simplification isn’t complete without a solid emergency fund. Set a goal to save three to six months of essential expenses. Break this larger goal into smaller monthly targets. Having this financial buffer reduces stress and prevents the need for costly debt when unexpected expenses arise. Ideally, you should set this into place, no matter your financial background. This is an extremely useful tool to have when life throws us a curve ball, that we all know happens in the blink of an eye! Dave Ramsey is my favorite financial program to follow in regards to building a emergency fund and following great financial rules.

Financial simplification and saving money are interconnected goals that reinforce each other. By implementing these strategies gradually, you’ll create a more straightforward financial life while building your savings. Remember, the goal isn’t deprivation but rather intentional spending that aligns with your values and long-term objectives. Start with one or two changes and build from there. As your financial life becomes simpler, you’ll likely find that your stress decreases while your bank account grows – a winning combination for the new year and beyond.

Remember, sustainable financial change comes from creating systems and habits that you can maintain long-term. Focus on progress over perfection, and celebrate small wins along the way to your larger financial goals. Happy New Year to you and your family!!