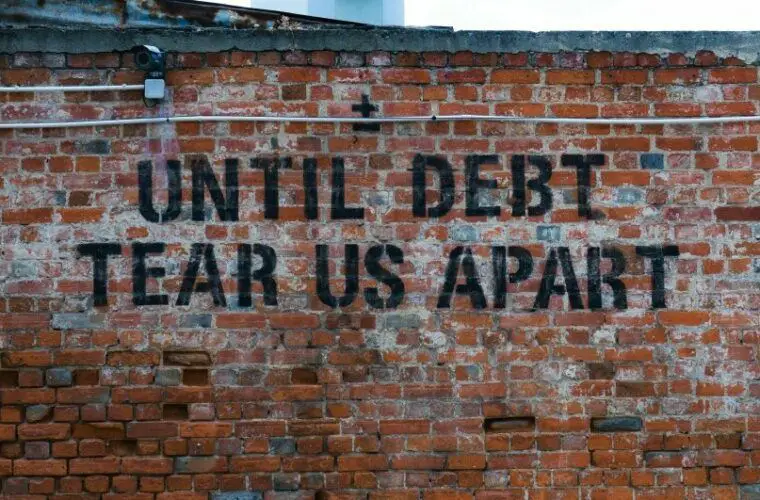

In this article, you’re going to learn how to pay off debt and achieve financial freedom. But before we get into the nitty-gritty details of all of that, I have one question for you…

Are You Sick Of Being Broke?

I know I am! I mean, seriously, who isn’t tired of being broke? It’s like, hello? Don’t we all want to be financially free?

But let me ask you another question: Have you ever wondered why so many people struggle with money and debt? Like, what’s up with that?

Here’s The Deal…

The reason most people struggle with money and debt is because they don’t know anything about personal finance. They don’t know how to budget their money or invest it properly. Heck, they probably don’t even know what interest rates are. (If you do, then give yourself a pat on the back because that’s something most people don’t know.)

And that’s exactly why I wrote this article. I wanted to help people who are struggling with money get out of debt and become financially independent.

Now, if you’ve been around the block a few times, you may think you already know everything there is to know about personal finance. But trust me, you don’t. Not really. There’s always more to learn. And in this report, you’ll discover some things you never knew about your money and how to use it effectively.

So Let Me Ask You Another Question…

Do you want to spend the rest of your life working hard just to pay bills and debt? Or do you want to break free from the rat race and live the kind of life you dream about?

Look, let’s face it. Life can be tough sometimes. But you know what makes it worse? Living paycheck to paycheck while trying to pay off debt.

That’s no way to live.

It’s time to take control of your finances once and for all. And the good news is that you can do it without sacrificing everything you hold dear.

How Do I Know This?

Well, here’s the thing…

Before I started teaching people about personal finance, I was right where you are now. I was drowning in debt and barely scraping by every month.

I had credit card debt, student loan debt, car loans, and mortgage debt. Oh, and did I mention I also had a ton of medical debt too? Yep, I had that too.

As you can imagine, it wasn’t much fun living like that. And honestly, I didn’t know how to escape the cycle of debt.

But Then Something Amazing Happened…

One day, I stumbled upon a book called “Your Money Or Your Life” by Vicki Robin and Joe Dominguez. Now, I’d heard about this book before but never read it.

But when I finally picked it up, and after I actually implemented the steps, something amazing happened.

This Book Changed My Life Forever…

I won’t go into all the details of the book. Instead, I’ll tell you what it taught me and how it changed my life forever.

First of all, it taught me how to budget my money correctly. No longer would I waste my money on junk stuff. Instead, I’d put it towards things that mattered. Like paying off debt and saving money. I literally think about money in a completely different way now. This book teaches you a completely different approach to money.

Second, it taught me how to invest my money wisely. I learned about stocks, mutual funds, real estate, and other ways to grow my wealth over time. It even taught me how to just save money better and easier, and use my money to make me more money.

Third, it taught me how to build multiple streams of income. So instead of relying on just one source of income, I could generate income from several sources.

Fourth, it taught me how to negotiate better deals, become more frugal and find ways to spend my money in more wise ways. Whether it’s buying a new car or hiring someone to fix my house, I learned how to get the best deal possible.

Finally, it taught me how to create a plan to achieve financial freedom. No longer would I just wing it each month hoping for the best. Instead, I’d have a roadmap to follow to ensure success.

In short, this book gave me hope. Hope that I could actually retire someday and enjoy the fruits of my labor.

And that’s exactly what happened…

After Reading That Book, I Was Able To Pay Off Over $25K In Debt…

Yep, you heard that right. After reading that book, I was able to pay off over $25K in debt. All of it.

Gone were the days of living paycheck to paycheck. Gone were the days of stressing out about money. Instead, I had a solid plan to achieve financial freedom and I was sticking to it, and sticking my budget on the wall!

And since then, I’ve helped thousands of others do the same. People who were buried in debt, just like me. People who felt hopeless about their financial future.

But after learning these strategies, they were able to turn their lives around. Some paid off tens of thousands of dollars in debt. Others even retired early.

And that’s exactly what I want to teach you in this blog…..

Here is a break down of what you can find in the book.

It starts by exploring the reasons why most people struggle with money. It looks at the psychology behind our spending habits and the myths surrounding money.

You also explore the basics of personal finance. From budgeting to investing, its all covered.

Then, you can focus specifically on getting out of debt. The book discusses different types of debt and how to prioritize them. As well as various strategies for paying off debt quickly, including debt snowballing and debt consolidation.

Finally, we’ll wrap up by talking about how to maintain your financial freedom once you’ve achieved it. We’ll discuss how to keep your expenses low, how to continue growing your wealth, and how to avoid common pitfalls that can lead to financial ruin.

Now, I know you may be thinking…

“Okay, great. But How Do I Make Sure This Stuff Actually Works For Me?”

Good question. Here’s the answer…

Here Are Some Reasons:

1. I’m not a guru. Unlike some other “financial experts” out there, I’m not pretending to be perfect. I’m just a regular person who has struggled with money in the past and overcome those challenges through education and determination.

2. I’m transparent. Everything I teach comes from my own experiences and research. So you can rest assured that everything I present is based solely on what works, and what has worked period.

3. I care about my readers. I genuinely care about helping people get out of debt and reaching financial independence.

P.S. Remember, this blog is designed to be easy to follow. Even if you’ve never thought about your money before, you’ll be able to understand and implement the strategies inside. So, go get this book, grab a cup of coffee, sit down, and get ready to transform your finances once and for all!

Disclaimer: Reading this book, or any finance book for that matter, will take patience and will power in an effort to implement the techniques that are discussed. If you are not willing to put forth an effort to make changes in your life, then I can not suggest you buy this book, or any other finance book. You must be ready to learn, open minded and prepared for, in some cases, major life changes. Good Luck, God Bless and Happy reading! Let me know how it goes!